Payment Security 101

Learn about payment fraud and how to prevent it

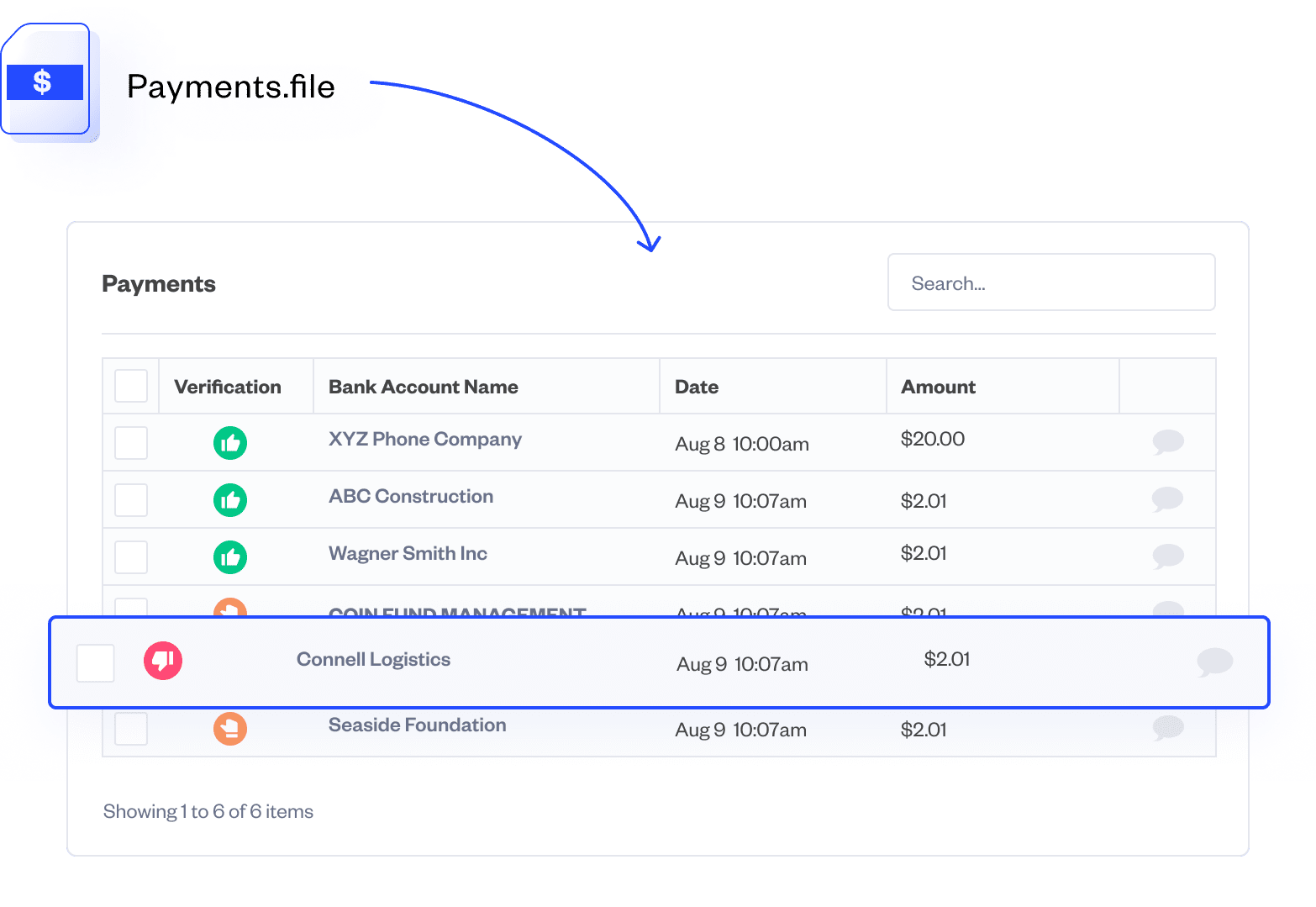

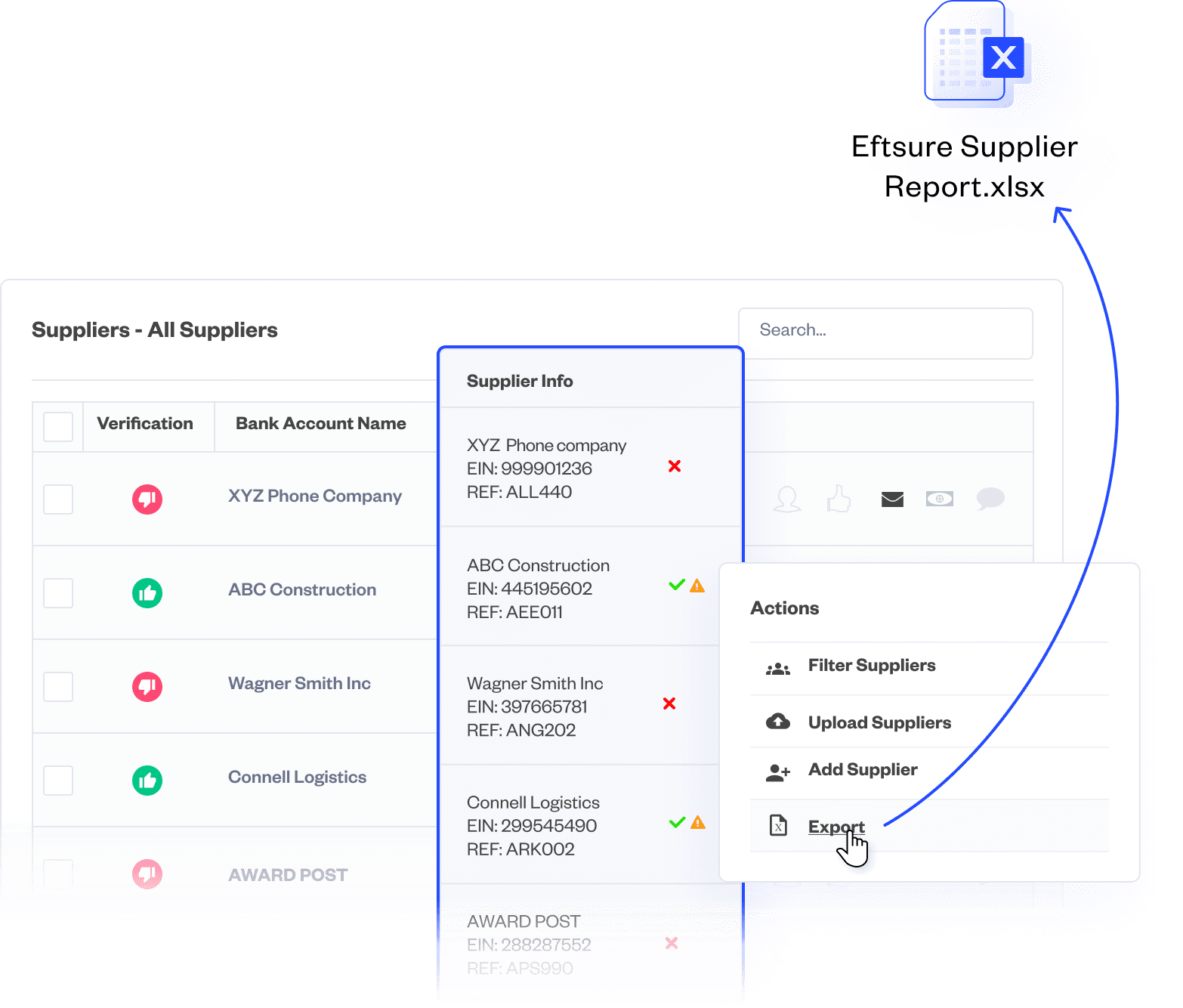

Review any payment or ACH file prior to banking. Our powerful thumb alerts will confirm you’re paying the right account name and number (green thumb) or in the case of red thumb, signal there is a mismatch between the bank account name, routing number, account number and EIN.

Eftsure will provide simple ‘traffic light’ alerts on your online payment screen. A green thumb indicates a verified vendor with a three-way match between Bank Account Name, Routing Number and Account Number and EIN data. A red thumb indicates a mismatch and is a lead indicator of error or fraud.

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.